If you’ve recently suffered a property loss, whether to your home or other insured property such as a business or commercial property, you need your just compensation. Your insurance company claims to have your best interests at heart, but do they really? The only way to know for sure is to hire someone who represents you in your insurance claim. This person is called a public adjuster, and he or she is the one who will work the hardest to get you the best settlement.

What Does the Public Adjuster Do?

Your public adjuster will help you get the most compensation for your loss, regardless of what your insurance company may already have offered. This person is state-licensed and an expert in the insurance industry, but they’ve chosen to work for you, the individual, rather than for the company.

Once you’ve filed an insurance claim for property damage, your public adjuster will step in to perform his duties, which may include:

- Examining your policy to discover the type and amount of coverage you’ve purchased.

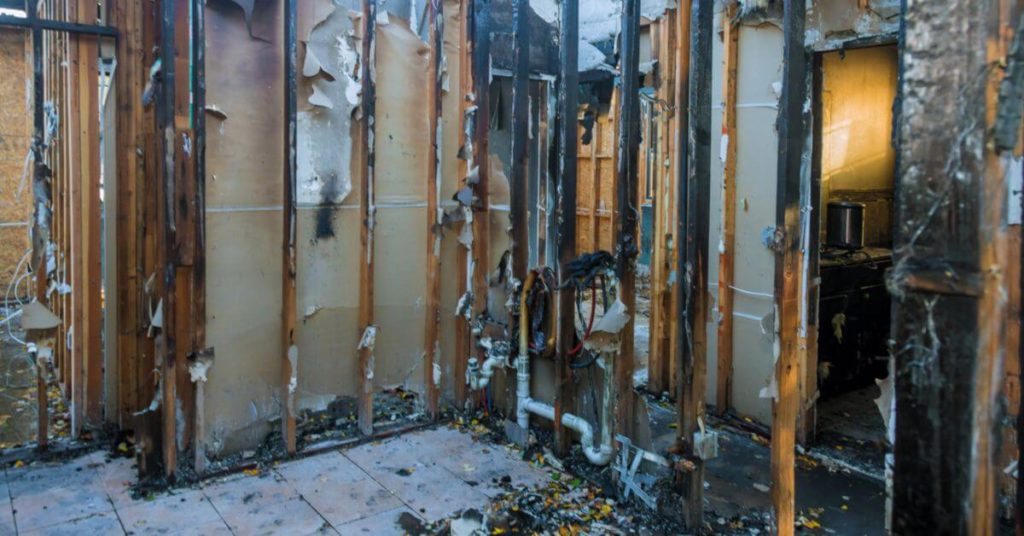

- Completing a visual inspection of the damage.

- Taking photographs to document your insurance claim.

- Estimating the costs associated with repairing or replacing the damaged property.

- Negotiating with your insurance company to obtain a fair settlement.

If you’re dealing with significant property loss that totals in the thousands, hiring a public adjuster is always recommended. While your insurance company employs adjusters who provide roughly the same service, these professionals have the company’s profits in mind and not the policyholders.

How Do I Know Whether I Need a Public Adjuster?

You need a public adjuster any time you’re faced with significant property loss. Whether your roof collapsed, a tornado uprooted your home, or you are the victim of property loss due to a natural disaster like a wildfire or hurricane. You’ll have to shell out the money to hire this professional, but often it’s possible to negotiate a percentage of your settlement as payment. This means no money upfront for the protection you absolutely need.

How Do I Choose the Right Public Adjuster?

Today, most public adjusters are required to be licensed and certified by the state in which they work. This means they had additional training beyond college and met the exam requirements necessary to gain certification. They are experts in their chosen field, and many worked for actual insurance agencies before deciding to jump ship and begin working for the policyholder.

When searching for the right public adjuster, ask to see copies of his or her license and ask about any previous insurance experience they may have. You might also ask about the dollar amount of their average settlement. You want someone with a proven track record of success to make the expense of hiring them worth your while.

If you’re currently locked in a battle with your insurance company over coverage for a recent loss, contact us today. Our fully licensed and certified representatives have proven track records and years of experience to put to work for you. Let us navigate the miles of red tape that’s involved with collecting on an insurance claim, so you don’t have to. Pick up the phone and gain peace of mind today.